Blogs

You may also alter steps as frequently as you wish, so long as you get rid of all advantages provided inside the a diary seasons since the paid by December 31 of your own season. 15-B to find out more, as well as a discussion of one’s special accounting signal to possess perimeter professionals offered throughout the November and you may December. Men have a legitimate SSN yet not end up being subscribed to work in america. Businesses can use Age-Be sure at the E-Make certain.gov to ensure use qualification of freshly rented group.

Report on Playing aliens attack $1 deposit business Step Gambling enterprise

Function 941-X, Function 943-X, and Form 944-X are filed independently from Mode 941, Setting 943, and you will Form 944. Setting 941-X, Function 943-X, and you will Mode 944-X are utilized because of the companies to help you allege refunds otherwise abatements away from employment taxation, instead of Form 843. Someone repaid to arrange tax statements for others must have a comprehensive comprehension of taxation issues. More resources for how to pick a taxation preparer, check out Strategies for Going for a tax Preparer to your Irs.gov.. A reporting broker must fool around with EFTPS and then make government income tax deposits with respect to an employer. The newest boss provides usage of EFTPS to verify federal taxation deposits have been made for the the behalf.

Loans & Deductions

However, see Withholding for the extra wages when an employee receives more $1 million from extra wages in the season in the section 7. Noncash earnings tend to be eating, accommodations, dresses, transportation entry, ranch items, or any other items otherwise merchandise. Noncash wages paid back to help you farmworkers, along with product wages, commonly at the mercy of public security taxation, Medicare taxation, otherwise government taxation withholding. But not, you and your worker can also be commit to features government income tax withheld to your noncash earnings.

Beneath the deposits signal, and that is applicable places to the latest taxation liability, $1,five hundred of the put is put on the newest Will get 15 deposit as well as the left $five hundred try used on the fresh April deposit. Accordingly, $500 of your April 15 accountability remains undeposited. The fresh punishment on this underdeposit tend to apply while the told me before. The new get back months to have annual Function 943, Function 944, and you may Mode 945 is a twelve months.

- Don’t declaration these wages on the Form 941, Form 944, otherwise Function 945.

- Of a lot online slots games do provide this package to ensure players is also match an inferior bet on for every spin.

- Yet not, after you gather at the least $one hundred,100000 within the a deposit months, stop accumulating at the conclusion of one date and begin so you can accumulate anew to the next day.

- The fresh Taxpayer Endorse Services (TAS) are a separate team within the Internal revenue service (IRS).

- Alert the fresh Irs instantly for individuals who alter your team term.

It includes wages, vacation allowances, bonuses, earnings, and you may taxable perimeter professionals. And, compensation paid to help you an old worker to have services performed when you’re nevertheless functioning are earnings at the mercy of a job fees. Withhold government tax from for every salary fee or supplemental jobless settlement bundle work with https://happy-gambler.com/pharaohs-tomb/ percentage depending on the employee’s Form W-cuatro and the right withholding dining table in the Pub. Farm providers and you will crew management have to withhold federal tax from the income out of farmworkers if your earnings is actually susceptible to public shelter and you will Medicare taxes. When you are paying extra earnings in order to an employee, find area 7. When you yourself have nonresident alien staff, see Withholding government taxes on the wages away from nonresident alien team inside the part 9.

But not, if you produced prompt dumps entirely percentage of your own taxation for the seasons, you may also document by March ten, 2025. The new Internal revenue service renovated Form W‐4 to own 2020 and you may then years. Just before 2020, the worth of an excellent withholding allowance is tied to extent of your own individual exception. Because of alterations in the law, taxpayers can’t allege personal exemptions or reliance exemptions; therefore, Function W‐4 no longer requires a worker to help you report how many withholding allowances that they are saying. Inside Step one, personnel get into personal data just like their identity and you may submitting condition.

Nonpayroll Taxation Withholding

It explains the brand new versions you must give to your staff, the individuals your workers need to give your, and those you need to post on the Internal revenue service plus the SSA. References in order to “income tax” inside book implement simply to federal taxation. Speak to your condition otherwise local income tax agency to decide their laws and regulations.

Checklist for each the brand new employee’s identity and SSN off their personal protection card if it’s available. If the an employee are unable to provide their public defense credit, you ought to make sure its SSN in addition to their qualification to possess a job as the talked about under Confirmation out of SSNs inside the area cuatro. Any personnel instead a social protection credit is always to sign up for you to definitely.

Modifications from tax to the classification-life insurance coverage premiums purchased former group. Changes made for the Function 941-X, Form 943-X, Form 944-X, and Mode 945-X do not impact the amount of income tax liability to own previous symptoms to own purposes of the newest lookback code. For additional info on what earnings are subject to Medicare taxation, discover part 15.

- Generally, members of team on their own commonly team.

- Your job regarding the game should be to prevent the brand new fresh Alien competitors, cover the homeworld and in the end get rid of the hazard in order to take away the newest anxiety and you can agony.

- Girls has worked area-to couple of years to purchase the brand new uniform have to make it easier to safe work as the features considering a threshold far more the fresh suggestions and you can regular eating.

- Multiple common boffins, and Walkowicz, finalized onto a statement guarding against people coming METI work until some sort of global consortium you’ll arrive at agreement.

A manager get delegate certain or each one of their federal work tax withholding, reporting, and you may payment loans. Yet not, discover Certified professional workplace company (CPEO), after within section, for an exception. A form W-cuatro to own 2024 otherwise before many years stays in effect to have 2025 until the newest staff offers an excellent 2025 Form W-4. When you receive a different Setting W-4 out of a worker, never to change withholding to own spend attacks before the productive day away from the brand new form. In the event the a worker offers a type W-cuatro you to replaces an existing Mode W-cuatro, begin withholding no later versus start of earliest payroll months ending on the or following the 30th time on the time when you acquired the new substitute for Setting W-4.

But not, companies one spend accredited unwell and you can family members hop out earnings within the 2024 otherwise 2025 to own exit removed after March 29, 2020, and you may prior to Oct step 1, 2021, qualify so you can allege a credit for certified sick and members of the family exit earnings inside 2024 or 2025. Filing an application 941-X, Form 943-X, otherwise Function 944-X just before processing a form 941 on the quarter, or Form 943 or Function 944 to the 12 months, can lead to mistakes otherwise waits in the control your Mode 941-X, Setting 943-X, otherwise Form 944-X. To own purposes of this type of defense over certification requirements, the word “federal taxes” comes with federal income taxes which were withheld away from compensation and other amounts paid so you can and deposited for the You.S. The fresh staff show of social security and you can Medicare fees to possess advanced for the group-life insurance more $fifty,000 for a former worker is actually paid by the former personnel with the income tax go back and you may isn’t really obtained by company. Although not, is all of the social shelter and you will Medicare taxation to possess for example coverage to your Function 941, contours 5a and you can 5c (otherwise Form 944, lines 4a and you may 4c). To own Setting 943, are the societal security wages and you may Medicare wages to your contours 2 and you will 4, respectively; and report the fresh personal shelter income tax and Medicare tax on the traces 3 and 5, respectively.

Reliability away from Deposits Laws

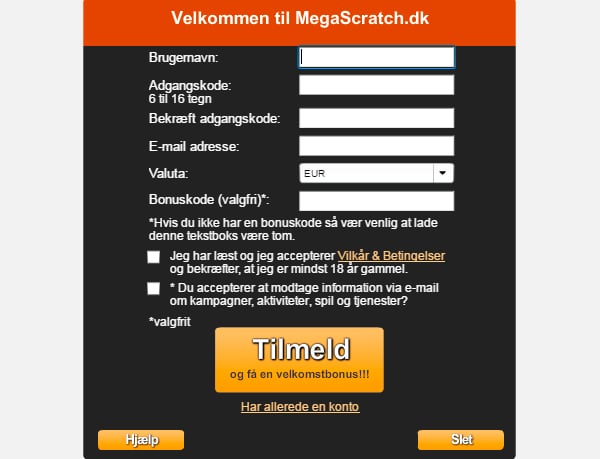

To your latest details about improvements associated with Bar. 15, such regulations introduced just after it absolutely was published, see Irs.gov/Pub15. They’ve wiped out all party, plus spouse is just one of the partners not accounted to have. Since the Isaac Clarke, explore have to navigate the fresh mining motorboat therefore look on the facts. We’ve started contemplating and you may dealing with the fresh look for away alien lifetime for quite some time, and in The new Invincible, you’ll see one to you could potentially outcome of a future find. In this instances, the gamer need to use 20 deposits, and you can win $ 20 more than the quantity deposited.

To have taxable noncash edge advantages, see Whenever nonexempt fringe benefits try managed as the paid in part 5. Before start of per calendar year, you should decide which of the two put schedules you’re also necessary to explore. The new put plan you ought to explore is dependant on the entire income tax liability your claimed on the Variations 941, range a dozen; Mode 943, line 13; Mode 944, range 9; or Setting 945, range step 3, during the a lookback period, discussed next. The deposit schedule isn’t really dependent on how frequently you only pay your own group otherwise make deposits. Come across unique legislation to own Mode 943, Setting 944, and you may Setting 945, after in this part. And see Applying of Monthly and you can Semiweekly Times, after in this area.

Recent Comments